Which Is Not An Exempt Housing Benefit . If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. Here's how to report this benefit on employee tax returns. Employee housing benefits may not be taxable to employees if they meet three conditions. “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where the rules that. Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential.

from www.slideserve.com

If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. Here's how to report this benefit on employee tax returns. Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where the rules that. The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. Employee housing benefits may not be taxable to employees if they meet three conditions. “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential.

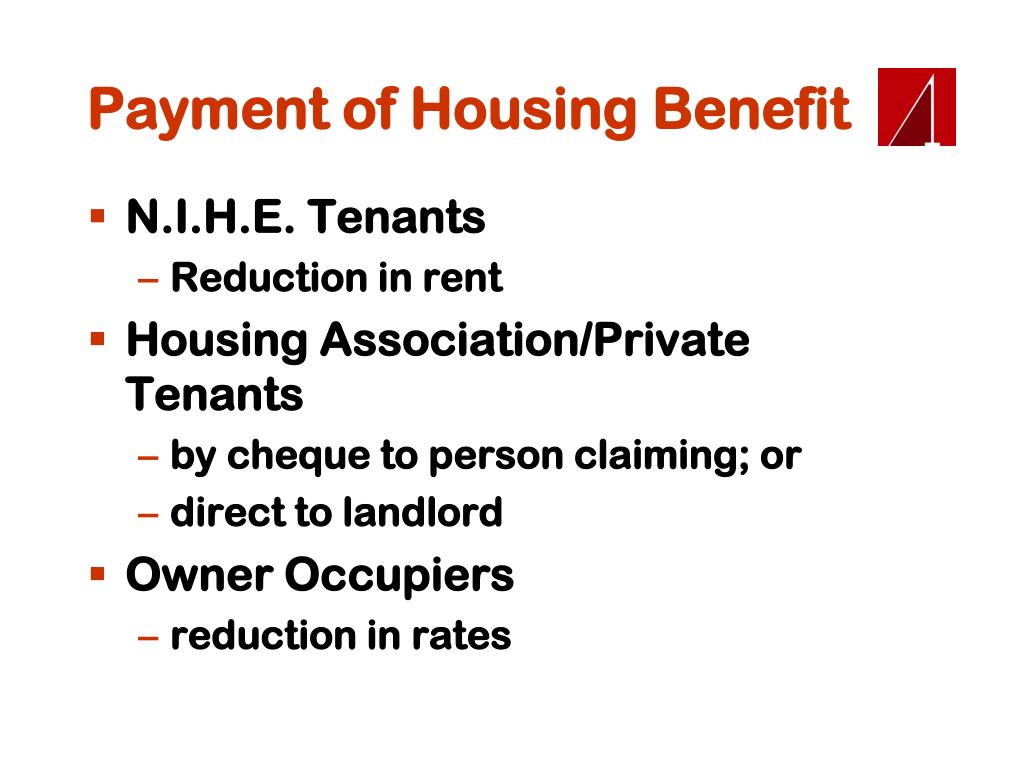

PPT Housing Benefit PowerPoint Presentation, free download ID4436767

Which Is Not An Exempt Housing Benefit Here's how to report this benefit on employee tax returns. “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where the rules that. If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. Employee housing benefits may not be taxable to employees if they meet three conditions. Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: Here's how to report this benefit on employee tax returns. Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential.

From www.cashfloat.co.uk

Housing Benefits Eligibility and How to Claim A Full Guide Cashfloat Which Is Not An Exempt Housing Benefit Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: “exempt accommodation” is. Which Is Not An Exempt Housing Benefit.

From www.slideserve.com

PPT Welfare Benefit Reform From Housing Benefit to Universal Credit Which Is Not An Exempt Housing Benefit The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. “exempt accommodation” is. Which Is Not An Exempt Housing Benefit.

From www.studocu.com

Housing benefit EJTJYYET Housing benefit What is a housing benefit Which Is Not An Exempt Housing Benefit Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. Employee housing benefits may not be taxable to employees if they meet three conditions. Here's how to report this benefit on employee tax returns. “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where. Which Is Not An Exempt Housing Benefit.

From www.slideserve.com

PPT Housing Benefit PowerPoint Presentation, free download ID4436767 Which Is Not An Exempt Housing Benefit “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where the rules that. Here's how to report this benefit on employee tax returns. Employee housing benefits may not be taxable to employees if they meet three conditions. Exempt accommodation is shared housing that is not funded or commissioned by local authority or social. Which Is Not An Exempt Housing Benefit.

From www.abcorg.net

Housing Benefit Increases This Month Association of Pensions Which Is Not An Exempt Housing Benefit Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where the rules that. Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. Here's how to. Which Is Not An Exempt Housing Benefit.

From thenyhc.org

Policy Analysis NYHC Which Is Not An Exempt Housing Benefit The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: Employee housing benefits may not be taxable to employees if they meet three conditions. Here's how to report this benefit on employee tax returns. “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax. Which Is Not An Exempt Housing Benefit.

From centralhousinggroup.com

Private Tenants, nearly are on housing benefit now Central Which Is Not An Exempt Housing Benefit Here's how to report this benefit on employee tax returns. If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential. Exempt accommodation is shared housing that is. Which Is Not An Exempt Housing Benefit.

From www.slideserve.com

PPT Housing Benefit, Exempt & Intensive Housing Which Is Not An Exempt Housing Benefit If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. Here's how to report this benefit on employee tax returns. Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. “exempt accommodation” has the meaning given in paragraph 4(10). Which Is Not An Exempt Housing Benefit.

From thenyhc.org

NYHC Introduces TaxExempt Housing Bonds Infographic NYHC Which Is Not An Exempt Housing Benefit Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. Here's how to report this benefit on employee tax returns. The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: Employee housing benefits may not be taxable to employees if they meet three conditions.. Which Is Not An Exempt Housing Benefit.

From www.taxhelpdesk.in

Tax Benefits on Home Loan Know More at Taxhelpdesk Which Is Not An Exempt Housing Benefit If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. Here's how to report this benefit on employee tax returns. “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential. Over $2.1 billion in benefits were distributed. Which Is Not An Exempt Housing Benefit.

From www.sampletemplates.com

FREE 14+ Sample Housing Benefit Forms in PDF Which Is Not An Exempt Housing Benefit Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: Here's how to report this benefit. Which Is Not An Exempt Housing Benefit.

From www.warrington.gov.uk

Benefits warrington.gov.uk Which Is Not An Exempt Housing Benefit “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential. Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. Here's how to report this benefit on employee tax returns. If you are claiming universal credit and living in supported exempt. Which Is Not An Exempt Housing Benefit.

From www.sampleforms.com

FREE 11+ Sample Housing Benefit Forms in PDF MS Word Which Is Not An Exempt Housing Benefit Exempt accommodation is shared housing that is not funded or commissioned by local authority or social care funding. “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where the rules that. If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing.. Which Is Not An Exempt Housing Benefit.

From www.slideserve.com

PPT Housing Benefit/Universal Credit Supported and Which Is Not An Exempt Housing Benefit The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program. “exempt accommodation”. Which Is Not An Exempt Housing Benefit.

From www.slideserve.com

PPT Housing Benefit/Universal Credit Supported Exempt Which Is Not An Exempt Housing Benefit “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where the rules that. “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential. Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program.. Which Is Not An Exempt Housing Benefit.

From www.slideserve.com

PPT Housing Benefit/Universal Credit Supported Exempt Which Is Not An Exempt Housing Benefit The housing benefit calculation uses three key figures that vary according to the circumstances of the claimant: If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. Employee housing benefits may not be taxable to employees if they meet three conditions. “exempt accommodation” has the meaning given in. Which Is Not An Exempt Housing Benefit.

From www.gov.uk

Benefit cap 200 people into work or off Housing Benefit every week Which Is Not An Exempt Housing Benefit “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential. If you are claiming universal credit and living in supported exempt accommodation any help with housing costs will be covered by housing. “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where. Which Is Not An Exempt Housing Benefit.

From kiracukaipendapatan.blogspot.com

CUKAI PENDAPATAN Manfaat Tempat Kediaman (Living Benefit) Which Is Not An Exempt Housing Benefit “exempt accommodation” has the meaning given in paragraph 4(10) of schedule 3 to the housing benefit and council tax benefit (consequential. “exempt accommodation” is a term used in housing benefit and universal credit to describe supported accommodation where the rules that. Over $2.1 billion in benefits were distributed to more than 1.8 million homeowners and renters during last season's program.. Which Is Not An Exempt Housing Benefit.